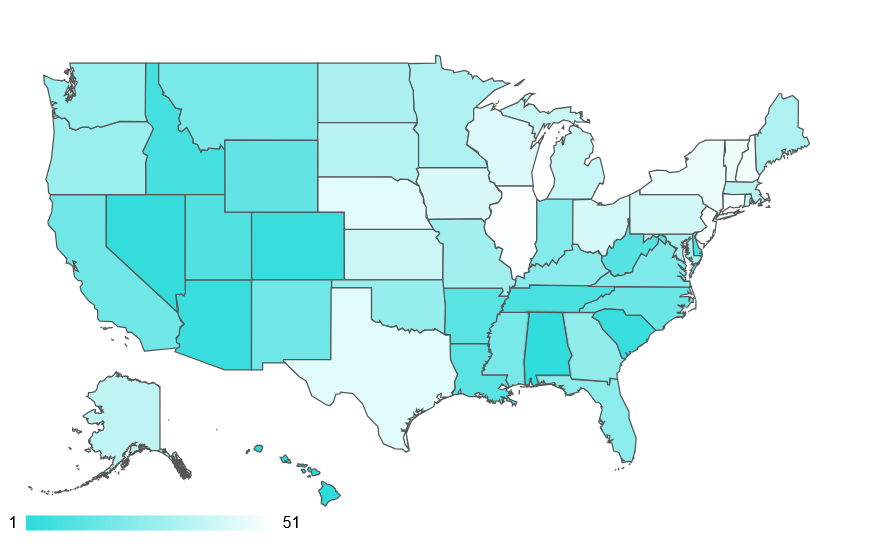

Alabama Ranks Among Lowest States for Property Taxes, WalletHub Study Finds

Alabama residents pay some of the lowest property taxes in the nation, according to WalletHub’s 2026 Property Taxes by State report released this week. The study compares real estate and vehicle property taxes across all 50 states and the District of Columbia, providing insights from a panel of tax experts.

The report found that Alabama ranks second lowest in real-estate property taxes, with homeowners paying an average of $788 annually on the median state home value, compared with $1,249 on the median U.S. home. Vehicle property taxes are slightly higher in the state, ranking 29th nationally, with an average of $203 on a best-selling car.

Nationwide, the average household pays $3,119 in property taxes on their home each year, and residents in the 26 states that levy vehicle property taxes pay an additional $499 annually. WalletHub notes that while about 35% of U.S. households rent, property taxes affect nearly everyone—either directly or indirectly—by influencing rental costs and funding local and state government services.

The study highlights how property taxes can range from a minor expense to a significant financial burden depending on the state. Alabama’s low ranking indicates a lighter tax load for residents compared with other states, trailing only Hawaii in terms of overall affordability.

WalletHub’s report also offers practical guidance for taxpayers on managing and potentially reducing property tax obligations, emphasizing the importance of understanding both real estate and vehicle tax liabilities in planning household budgets.

Click here to see the full study: https://wallethub.com/edu/states-with-the-highest-and-lowest-property-taxes/11585