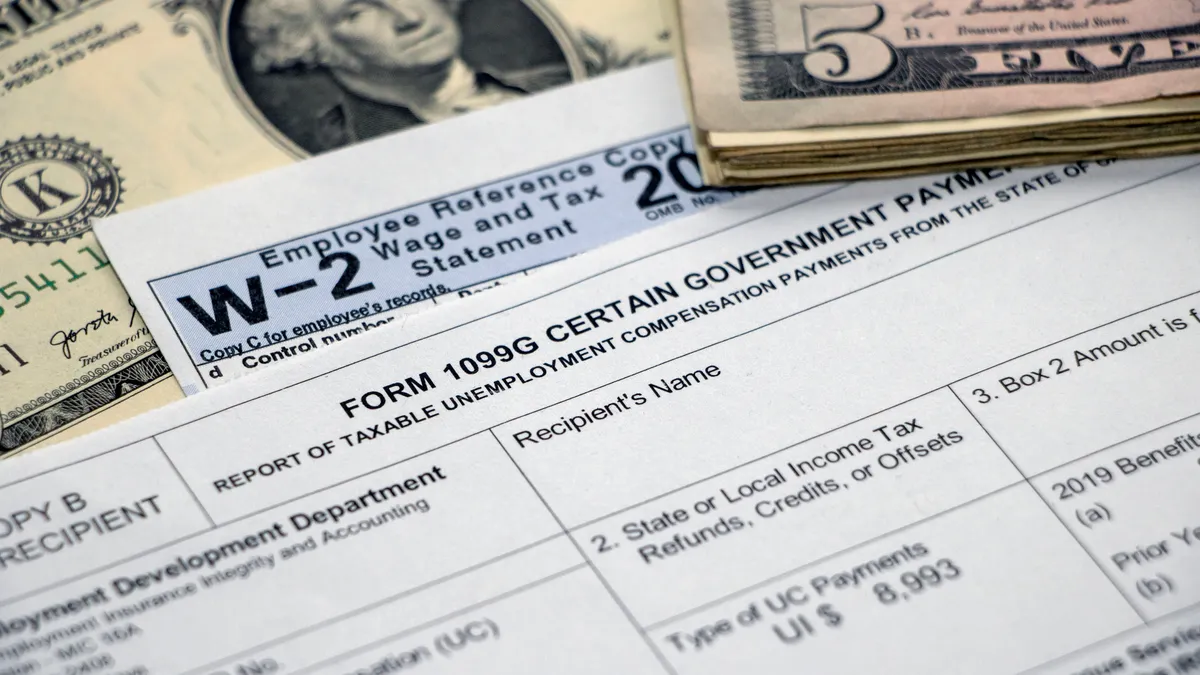

IRS Warns of Dangerous New Tax Scam Involving W-2 Forms

IRS Warns of Dangerous New Tax Scam Involving W-2 Forms

The IRS is warning the public about new Tax Scams this season – including one that is encouraging people to defraud the government. There was more than $5.7 billion in tax fraud in 2022 alone, according to the IRS, and illicit schemes are already on the rise in 2023.

One popping up on social media is telling people to manually fill out a W-2 Form with false income information in order to score a large refund. According to a March 3 IRS bulletin, filers are encouraged to invent large incomes and withholding figures, make up a fictional employer and then submit a return electronically, in hopes of getting as much as five figures back from Uncle Sam.

One version of that scam is directed at self-employed people who’ve claimed credits for sick leave or family leave using Form 7202. That con artist will then urge them to claim a credit based on income earned as a salaried employee, not as someone who’s self-employed. (These type credits were available for 2020 and 2021 returns to help those impacted by COVID-19, but are no longer applicable.) Another variation tells people to make up household workers and try to claim a refund based on sick leave and family wages they never paid out, using a Schedule H (Form 1040).

According to the IRS, at the very least, submitting false tax paperwork can result in a $5,000 fine for a Frivolous Tax Refund penalty – and, there is also the risk of criminal prosecution.

(CNET)